Hi, I'm Shari Storms. I am a licensed customs broker with Pacific Customs Brokers Canada. My topic today is shipping to Canada and tips for avoiding delays with Canada customs clearance. Costly delays and customs clearance are often caused by missing information on the documentation. Customs documentation is one of the most important elements of international shipping. Once you have determined that your commodity is admissible into Canada, accurately completed documentation will help your shipment reach its destination on time and reduce the risk of it being held up by customs. What documentation do you need to ship to Canada? There are countless requirements set down by customs for various types of commodities and circumstances. It is not possible to fit this question into a one-size-fits-all answer. However, we need to look at the fact that although each commodity could have a vast array of documentation requirements, the minimum requirements are often the same. All exports to Canada require specific information for clearance through Canada customs, and the Canada customs invoice is the most common form utilized. A commercial and/or sales invoice can be used instead of a Canada customs invoice, provided that the required information is included. The required information includes the vendor, also known as the party selling the goods to the purchaser and/or the party consigning the goods to Canada. The importer of record, meaning the party responsible for importing the goods into Canada and paying any duties or taxes. A full description of all items in layman's terms is also necessary. It is important that the invoice clearly indicates what the item is, what it's used for, and what it's made of. Another common missing piece of information is the country of manufacture for each item shipped. Quantity, meaning the number of packages and weight being shipped, value unit prices...

Award-winning PDF software

Custom broker fees Form: What You Should Know

A customs broker makes all the calls, makes sure all documentation is correct, and also arranges a meeting with customs officials in advance to discuss your paperwork. What About Exported Goods? In addition, duty is imposed on exports, when they are taxable at a reduced rate, but you may have to collect and pay additional taxes after exporting your goods. These fees vary a bit depending on the country, but they are typically very expensive. So what should you charge? If you are importing foreign goods, the standard price is generally lower than that for domestic goods. Generally, the dealer will make a good deal of his profits by keeping the cost for domestic processing low. So when you negotiate the import fee and tax amount, bear in mind that you will likely be negotiating a price that a dealer's profit actually will be in the neighborhood of the regular price, or a premium. For example: If you are dealing in wine from Spain and pay 30% duty on the whole shipment because you are exporting it, then you're actually paying 30% more for the merchandise than you would have if you had imported it, in our price comparison. The same is true for most other goods. You are probably best served by charging a slightly higher price for your own product than you would if you were selling it on the open market. So in terms of price or pricing. How much is it to import goods into the US from your country? Here is a list of common prices for import duty and taxes on imported goods from other western countries. This is just a few of the possible costs that you may face. United States Customs and Border Protection (CBP) If you're an importer you are not the only one who is going to have to handle customs and handling your shipment. You should also pay the duty on your product. This can be complicated depending on your country, and you might want to speak to a business agent that specializes in duty and taxes. If you import wine or spirits, these must be collected as a specific shipment from the country of importation and are considered a taxable export. If you export these goods, you can apply to have these duties charged against your own customs broker's account, but you may have to pay additional duties.

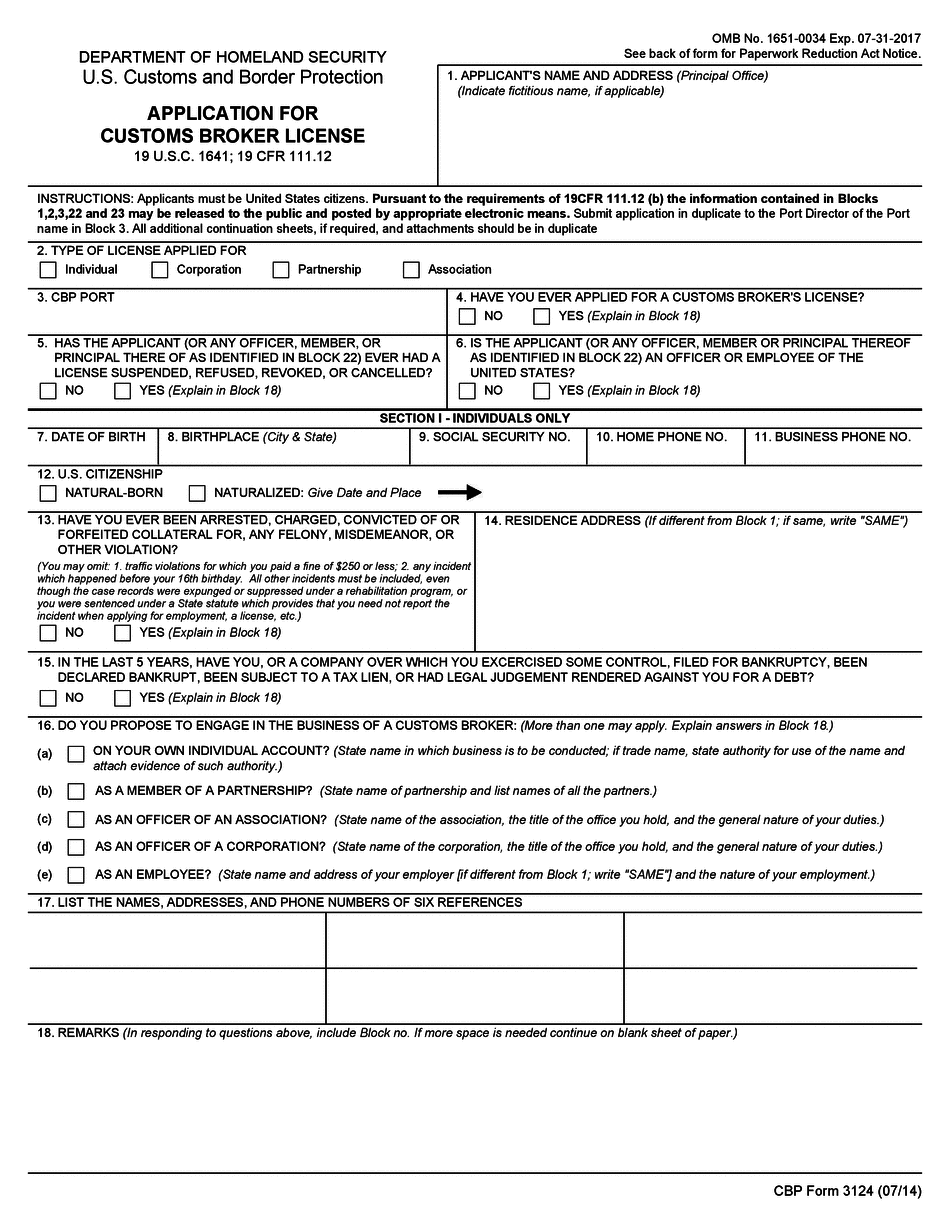

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CBP Form 3124, steer clear of blunders along with furnish it in a timely manner:

How to complete any CBP Form 3124 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CBP Form 3124 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CBP Form 3124 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Custom broker fees